The Game Is Rigged

In Australia, just like in the U.S.

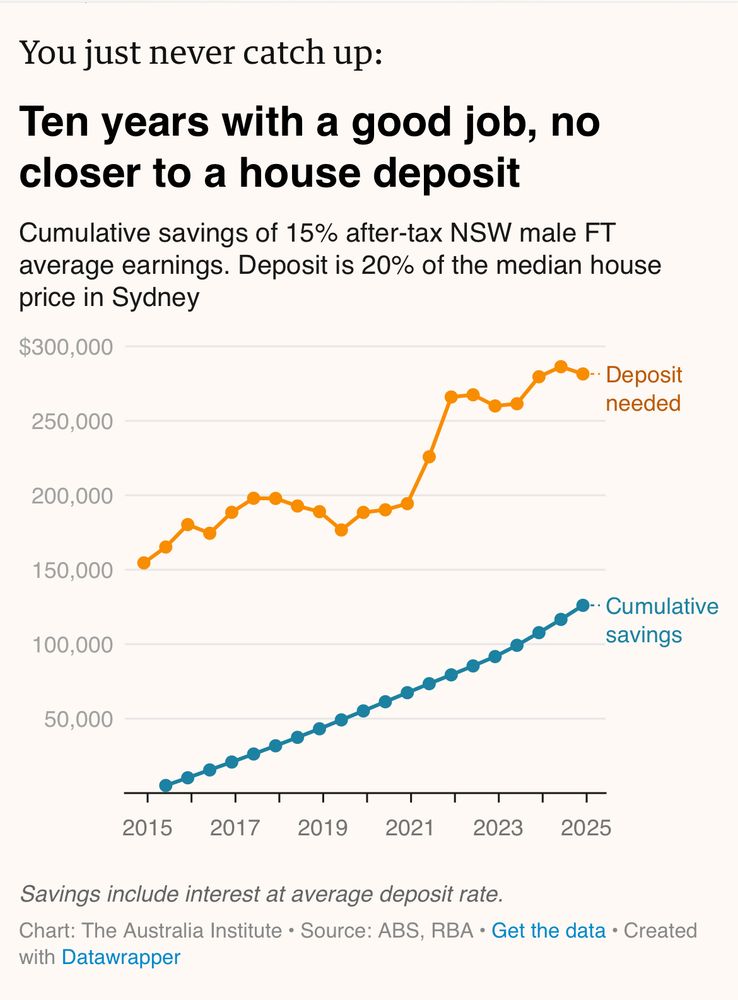

I read a piece from The Guardian’s Australian edition that demonstrates an implacable reality:

NSW is New South Wales for those far from Australia.

The author, Greg Jericho, who is the chief economist of the Australia Institute, spells it out:

For many, though, regardless of what the figures say, the idea of being able to afford a house is so far beyond reality that they might as well envisage buying a place in a neighbourhood of hobbits.

Too often the difficulty is rendered in abstract terms, but the Australia Institute (where I am the chief economist) can now reveal just how cruel things are – and have been for many years.

He lays out a scenario where someone started saving 15% of a more than $100,000 income in 2015:

By the end of 2024, a decade after starting, you have saved up $126,096. Not only are you still not at your original goal, you are $155,404 behind the $281,500 deposit you now need to buy a median-priced house in Sydney.

The game — at least in Australia — is rigged. The answer is more housing, just as it is in the U.S.