Word of the Day: Financial Nihilism

Yes, I know it's a phrase, not a word, but...

| Travis King, Financial Nihilism

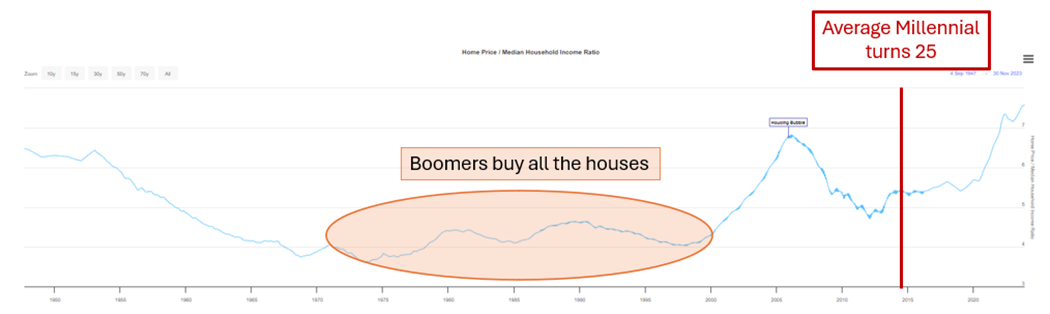

King continues with a long collection of graphs on the inequality of wealth across generations and leads into a description of the motives behind the rise of online gambling, meme stocks, and cryptocurrency: Gen X and Millennials see the writing on the wall and are gambling—in various forms—because the game is rigged against them.

Financial nihilism goes hand in hand with populist politics — or what I call ‘bottom left’ and ‘bottom right’ political orientation — as King points out. Bottomers, for example, believe the system is rigged and that nearly all institutions — political, educational, financial, religious — are corrupt, and the elite that dominate society don’t give a damn about anything but their own self-interest.

Bottom lefters may agree with many left-wing positions but are just as likely to buck other progressive positions, such as a strong antipathy to immigration. To left-wing progressives, they may seem right-wing, but it’s just their populist nihilism shining through.